NEXT

EVENTS

Financial strategy

Iberdrola’s financial profile

Fixed income capital markets represent an important source of funding for the Iberdrola Group. Financial strength is one of Iberdrola’s three strategic pillars, alongside profitable growth and a sustainable dividend. The Group’s financial objective is therefore focused on maintaining strong financial ratios, aligned with the requirements of rating agencies for a solid investment-grade profile.

Strategic plan 2025-2028 update: Energy outlook [PDF]

Debt capital represents an important financing source for the Iberdrola Group. Central to Iberdrola’s financial strategy is its target financial ratios.

Iberdrola seeks to, whenever possible, centralize its financing activities, however there are circumstances when the Group considers it necessary to arrange finance at the subsidiary level. This means that the majority of financing is conducted at the Iberdrola S.A. level or conducted through instruments with the guarantee of Iberdrola S.A.

Iberdrola S.A. places importance on having a diversified investor base and on reducing financing risks. Iberdrola therefore issues in different markets, currencies and with varying maturities.

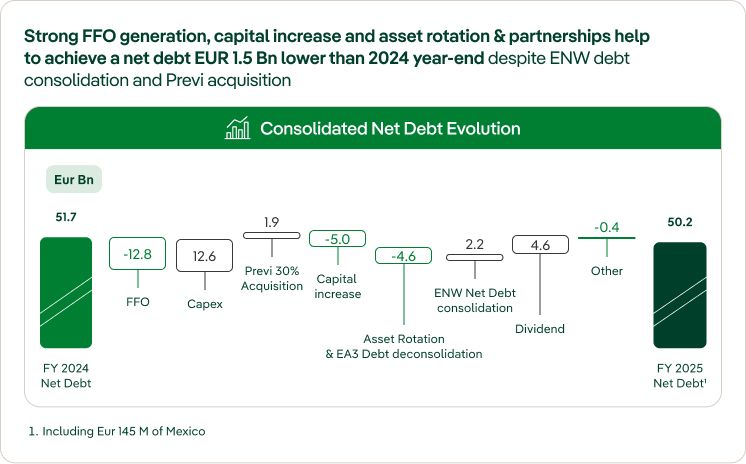

The illustrations below show Iberdrola Group’s solvency ratios and adjusted net debt on 31 December 2025 showing the financial strength of the group.

Iberdrola delivers solid credit ratings

Adjusted Credit Metrics

- Adjusted Net Debt² /EBITDA 3.02x

- FFO / Adjusted Net Debt² 25.5%³

- Adjusted Leverage 43.8%

- 3.40X

- 22.9%

- 45.4%

¹ Ratios including Mexico: FFO (EUR 500 M) and Net debt (EUR 145 M), excluding Mexico FFO/Adjusted Net Debt is 24.6%

² Adjusted for treasury stock derivatives with physical settlement which at the current date are not expected to be executed (Eur 944 M as of 2025 and Eur 995 M as of 2024)

³ Proforma ratio including 12 months of ENW contribution is 25.7%

Debt as of 31 December 2025 can be broken down by currency* and interest rate, as follows:

The structure of financial debt by interest rate* is as follows

The breakdown of debt* by market

Liquidity profile of the Iberdrola Group

The slide below shows Iberdrola Group’s liquidity position and debt maturity profile* 31 December 2025: