News

-

22/08/2025Neoenergia opens a new section of the Morro do Chapéu transmission line Neoenergia, Iberdrola’s subsidiary in Brazil , began commercial operation this month of the Poções III/Medeiros Neto II section in Bahia, which forms part of the Morro do Chapéu transmission line project. Construction was completed in the second quarter, finalising the in stallation of 633 MVAr at the Poções III and Medeiros Neto II substations, allowing the project to become operational in August. Spanning 317 kilometres, comprising 629 towers and operating at 500 kV, this section of the transmission network is the fourth of five in the Morro do Chapéu project, which is part of Lot 2 of the auction held by the National Electric Energy Agency (Aneel) in 2020. Strategic national function With a total length of 1,091 kilometres, crossing the states of Bahia, Minas Gerais and Espírito Santo, the Morro do Chapéu project will be responsible, among other benefits, for transporting energy to support the expansion of the main grid in the southern part of the Northeast Region. The transmission line will facilitate the transport of energy from already contracted power plants in the region and will increase capacity for the connection of new generation projects. You can read the full story at the Neoenergia press office . READ MORE

-

21/08/2025 - 13:31 UTC +02:00East Anglia THREE offshore converter station jacket beds down in North Sea Weighing in at around 3,700 tonnes and standing 59 metres high, the four-legged jacket foundation for the green energy company’s £4 billion East Anglia THREE offshore windfarm is now fixed to the seabed – 69km off the coast of Suffolk – at a water depth of 36m. The installation was completed by Heerema Marine Contractors’ SSCV Sleipnir – the biggest crane vessel in the world – after sailing in from Aker Solutions’ Verdal fabrication yard in Norway. The 1.4 GW East Anglia THREE offshore windfarm will be the biggest-ever windfarm across the whole of the Iberdrola group and among the largest in the world when it comes into operation at the end of 2026 – producing enough clean energy to power the equivalent of more than 1 million homes. Pedro Fernandez, ScottishPower Renewables’ East Anglia THREE Project Director, part of Iberdrola's subholding company in the United Kingdom , said: “The offshore construction programme for East Anglia THREE is the biggest feat of engineering we’ve ever undertaken – to see 3,700 tonnes of steel lifted safely and securely into place, with exacting and medical precision, is a truly impressive sight. You can read the full story in the Scottish Power Press Room . READ MORE

-

20/08/2025 - 11:43 UTC +02:00Avangrid completes solar module production at SEG Solar’s new plant in Texas Avangrid, the US subsidiary of the Iberdrola Group , has completed the assembly of more than 200,000 solar modules manufactured by SEG Solar at its new plant in Houston, Texas. These modules will be installed at Avangrid’s Tower Solar project, with a capacity of 166 MWdc (120 MWac), located in Morrow County, Oregon. The facility will supply power to Portland General Electric’s (PGE) grid and support Meta’s data centre operations in the region. Avangrid’s Tower Solar project is currently under construction and is expected to be completed in 2026. The facility will deliver clean, renewable energy to PGE’s grid through the Green Future Impact (GFI) programme, a voluntary initiative designed to help commercial, industrial and institutional customers achieve their sustainability and carbon reduction goals by developing new clean energy facilities in the region. You can read the full story in Avangrid’s Press Room. READ MORE

-

18/08/2025 - 18:37 UTC +02:00Iberdrola’s management team meets in Bilbao as company hits record market valuation Iberdrola Executive Chairman, Ignacio Galán , met today in Bilbao with the company’s management team during his traditional gathering held on the occasion of Bilbao’s Aste Nagusia. Executive Chairman Galán congratulated the people of Bilbao on their Semana Grande festivities and reaffirmed the company’s Basque roots, as it prepares to celebrate its 125th anniversary next year. The meeting comes just weeks after the completion of two major operations for Iberdrola: a €5 billion capital increase to finance growth investments in the networks business in the United Kingdom and the United States , and the agreement reached for the divestment of operations in Mexico for $4.2 billion. The market has responded very positively to both transactions, with a share price increase of more than 7% since the capital increase was executed, comfortably surpassing the pre-operation valuation. As a result, Iberdrola now exceeds €108 billion in market capitalization, consolidating its position as the leading private utility in Europe and the second largest in the world by market capitalization. Commitment to the Basque Country Iberdrola’s economic impact in Euskadi in 2024 exceeded €3.5 billion, with a total contribution of more than €11 billion to the Basque economy over the past three years. Specifically, Iberdrola contributed nearly €800 million to the Basque tax authorities in 2024, a 15% increase, and made purchases worth more than €2 billion from over 520 Basque suppliers. READ MORE

-

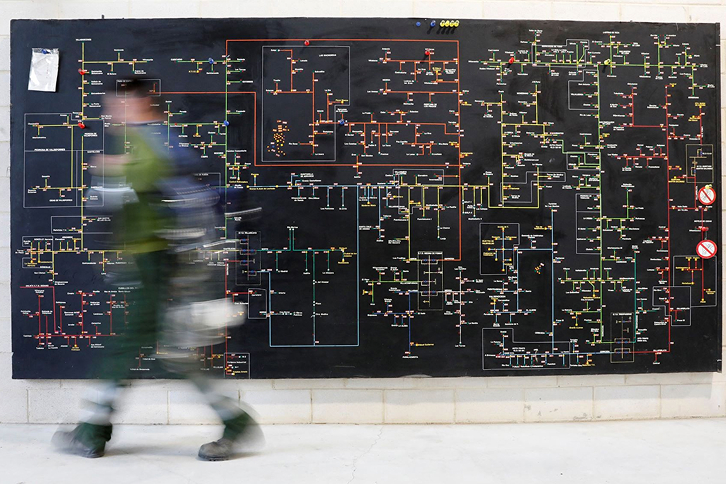

18/08/2025 - 12:00 UTC +02:00Iberdrola continues to promote quantum technology’s development and knowledge transfer Iberdrola España, Iberdrola's subsidiary in Spain , and the Basque Government's Department of Science, Universities and Innovation have signed a long-term partnership agreement to research quantum computing ’s application to different areas of the energy industry, develop new technological capabilities and encourage knowledge transfer. The agreement is part of the BasQ (Basque Quantum) Strategy promoted by the Basque Government, which positions the Basque Country, in northern Spain, as one of the most advanced European hubs for quantum technologies. For Iberdrola, this partnership reaffirms its commitment to technological innovation as a driver of transformation in the energy model. The company is exploring the potential of quantum computing to optimise smart grids , improve weather forecasting, simulate advanced materials and accelerate energy efficiency algorithms. This strategic partnership strengthens the collaborative fabric between science, business and institutions, and is a decisive step towards an advanced, sustainable innovation model connected to major global technological challenges. You can read the full story at the Iberdrola España Press Room . READ MORE

-

14/08/2025 - 15:22 UTC +02:00Paula Leitón and Ana Peleteiro join the Iberdrola Ambassadors programme to promote equality through sport Iberdrola España, the company’s Spanish subsidiary, is further strengthening its commitment to promoting gender equality through sport with the recent addition of Paula Leitón and Ana Peleteiro to its Iberdrola Ambassadors programme. These two Spanish athletes join the 35 other sportswomen and role models who work to enhance the visibility and leadership of women in sport, and whom the company seeks to give maximum exposure to in the media and on social networks. Since 2016, Iberdrola España has been the main driving force behind women’s sport. It currently supports more than 600,000 athletes through its sponsorship of 35 national federations and lends its name to over 100 competitions. Thanks to this commitment, in the past nine years the number of female members in these federations has grown by more than 80%, reaching nearly 820,000. You can read the full news stories in Iberdrola España’s Press Room: * Paula Leitón lends her strength to the Iberdrola Ambassadors programme to promote equality through sport * Ana Peleteiro joins the Iberdrola Ambassadors programme to boost the drive for equality through sport READ MORE

-

14/08/2025 - 09:06 UTC +02:00Iberdrola generated enough energy in the US in the first half of the year to supply 2.4 million homes. Iberdrola, through its subsidiary Avangrid , generated around 13,000 gigawatt hours (GWh) of energy in the US in the first half of the year, enough electricity to supply about 2.4 million households in the country. Specifically, the group chaired by Ignacio Sánchez Galán has a total of 80 operating power facilities from coast to coast in the country, with a combined generation capacity of over 10.5 gigawatts (GW). At the start of the year, Iberdrola’s subsidiary announced the commercial operation of three new solar projects in Texas, California and Ohio, representing approximately 600 megawatts (MW) of new capacity. This helped increase Avangrid’s solar energy output by 125% compared to the first half of 2024. Since 2015, Avangrid has increased its generation capacity by 66%, the company reported. Avangrid highlighted that the energy generated by its growing portfolio of energy projects “demonstrates the company’s recognition of the US’s critical energy needs and its commitment to investments that deliver reliable and affordable energy to American homes and businesses, thereby contributing to achieving US energy dominance and meeting the rapidly growing demand.” Iberdrola’s US subsidiary currently has 10 projects supplying over 1.5GW of energy to data centres and leading technology and artificial intelligence (AI) companies in the country. In addition, the group has a further five projects under construction, totalling nearly 700MW, which are helping these companies meet their urgent energy needs. Strategic commitment to the US In March, Iberdrola reaffirmed its commitment to the US, with investment plans of over $20 billion (about €18.303 billion) in grid infrastructure through to 2030. The US is a strategic country for the energy company. In fact, last July it completed a capital increase of about €5B to finance the investment plan to accelerate its growth in electricity networks there and in the UK, mainly. The utility, which will hold its Capital Markets Day in London on 24 September, expects its network asset base to exceed €90 billion in 2031, compared to €30 billion in 2020, tripling in just a decade. You can read the full article in Avangrid’s Media Room . READ MORE

-

11/08/2025 - 12:20 UTC +02:00The Eastern Green Link 4 project reaches a new milestone with the selection of the preferred bidder ScottishPower Energy Networks, Iberdrola's distributor in the United Kingdom , and National Grid Electricity Transmission reached an important milestone in the development of the Eastern Green Link 4 project (EGL4), a new subsea electricity 'motorway', by choosing Siemens Energy as the preferred bidder for the project's two high-voltage direct current (HVDC) converter stations. EGL4 is a new 2 GW high-voltage direct current subsea power link that will transport clean, domestically produced energy between Fife, Scotland and West Norfolk, England. This 530 km high-voltage cable will increase the region's energy capacity and security. Much of the UK's new offshore and onshore wind generation is located in or around Scotland, but the current transmission grid does not have the capacity to transport all this clean electricity to where it is needed most. Long-distance, bidirectional subsea infrastructure such as EGL4 is essential to strengthen the UK's energy security with domestic energy and keep bill prices down by reducing dependence on imported and expensive fossil fuels. EGL4 recently completed its second phase of public consultation at both ends of the link. Construction is expected to begin in 2029, with the project coming online in 2033. You can read the full news story at the ScottishPower Energy Networks Press Room . READ MORE