IEA World Energy Outlook 2025

What is the World Energy Outlook report?

Investment Decarbonisation Climate change

The International Energy Agency's  World Energy Outlook 2025

World Energy Outlook 2025  offers one of the most comprehensive analyses of how global energy systems are evolving at a time of profound transformation. Its conclusions are clear: electrification, supported by renewable energy, modern networks and digital technologies, is now the most cost-effective and secure pathway to achieving net zero emissions. The report sets out three scenarios to understand how different policy and technology choices could shape the coming decades. In all of them, electricity plays a central role.

offers one of the most comprehensive analyses of how global energy systems are evolving at a time of profound transformation. Its conclusions are clear: electrification, supported by renewable energy, modern networks and digital technologies, is now the most cost-effective and secure pathway to achieving net zero emissions. The report sets out three scenarios to understand how different policy and technology choices could shape the coming decades. In all of them, electricity plays a central role.

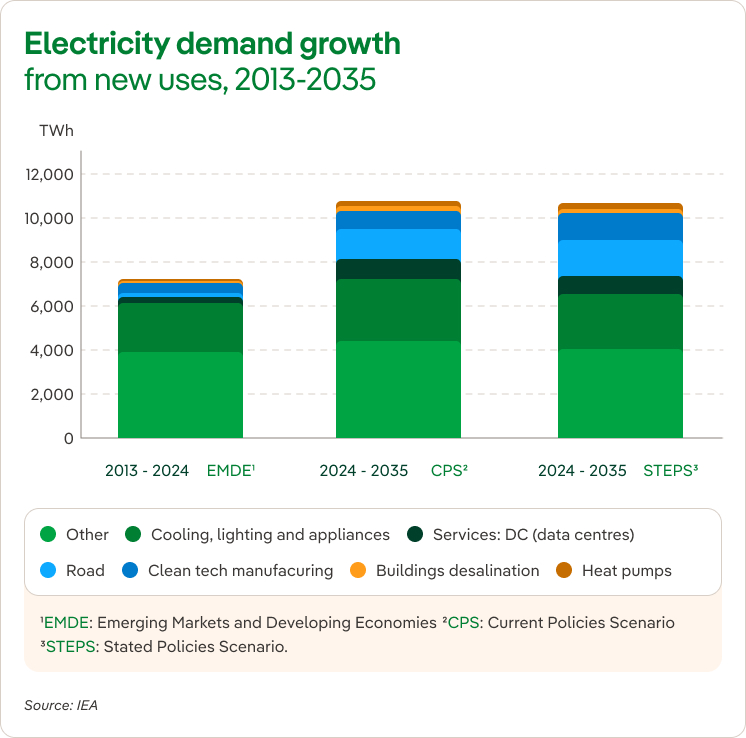

The rise of artificial intelligence and data centres, the expansion of electric mobility and the growing use of cooling and heating will lead the world into a decade in which electricity demand increases at an unprecedented pace. At the same time, the World Energy Outlook (WEO) 2025 warns that this rapid shift requires robust, forward-looking investment in networks, storage and critical minerals supply chains to ensure a resilient and secure transition.

The World Energy Outlook report: a way to understand how global systems are evolving

The World Energy Outlook from the International Energy Agency (IEA) is the most widely recognised and authoritative annual energy report, offering a global analysis of energy. As the IEA’s flagship publication, the WEO 2025 assesses the main trends in energy demand, supply and technological development, analysing their implications for energy security, economic growth and sustainability.

It uses detailed data and scenarios to guide policymakers, companies and citizens on the challenges and opportunities that will shape the global energy future and explores the different possible pathways ahead. By integrating current policies, technological innovation and market developments, the WEO has become an essential resource for understanding how global energy systems are evolving and which routes could lead to a safer, more affordable and decarbonised future.

Three scenarios analysing the future of renewable energy

The WEO 2025 does not make predictions but instead sets out a series of scenarios based on an assessment of the current situation and developed from the potential progress of public policies and technological improvements. The report covers the entire energy system, using three scenarios that show how it could be affected by a range of variables in the coming years.

The three scenarios considered by the IEA’s World Energy Outlook are as follows:

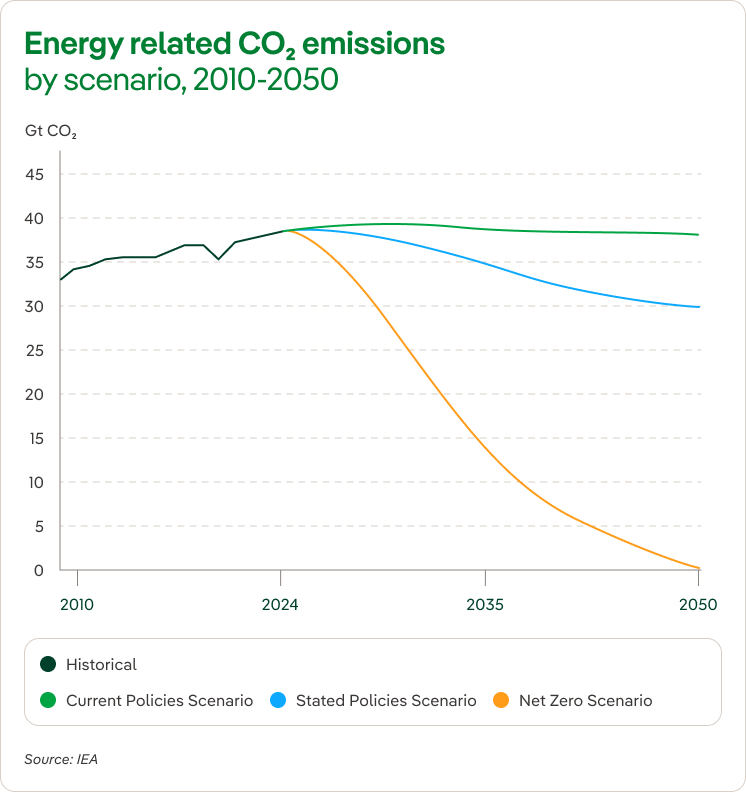

- Net Zero Emissions Scenario (NZE). It describes a pathway to reduce global energy-related CO₂ emissions to zero by 2050 and limit global warming to 1.5°C by 2100, after peaking at 1.65°C in 2050.

- Stated Policies Scenario (STEPS). It considers the implementation of a wide set of policies, including some that have already been proposed but not yet adopted, without assuming that aspirational targets are met. This scenario would result in global warming of 2.5°C over the same period.

- Current Policies Scenario (CPS). It offers a snapshot of policies and regulations already in force and presents a cautious view of how quickly new energy technologies will be integrated into the system, with global warming reaching 2.9°C by 2100.

Total electrification: the route to lowest cost and highest profitability

The main conclusion of the World Energy Outlook 2025 is that achieving net zero emissions through full electrification is the most cost-effective strategy for the global energy system.

The NZE scenario shows that replacing the use of fossil fuels with electricity, particularly from renewable sources, significantly reduces overall energy system costs. This is due to the rapid decline in the cost of wind and solar technologies and the fact that they have virtually no fuel costs. What’s more, electrification improves energy efficiency in sectors such as transport, industry and buildings.

The Net Zero Emissions scenario requires higher upfront investment in clean technologies but, once installed, delivers savings of trillions of dollars in fuel costs, while also protecting consumers from price volatility. The report explains that households in advanced economies would see their energy costs fall, while in emerging economies they would remain stable thanks to efficiency gains and electrification.

This system not only supports environmental objectives but also represents an attractive financial pathway for governments, utilities and private investors. The scenario shows that electrification is not merely an environmental obligation, but also an economic opportunity that strengthens energy security in a decarbonised future.

The CPS scenario, by contrast, is the most expensive, due to higher operating costs and continued dependence on fossil fuels, exposing economies to price shocks and volatility.

The net zero emissions scenario offers the lowest total system cost

The NZE scenario in the WEO 2025 shows that, although a higher initial level of investment is required in clean technologies such as renewables and storage, these costs are more than offset by substantial long-term savings. The scenario projects that trillions of dollars in fuel costs will be avoided thanks to reduced reliance on fossil fuels. These savings would lower operating costs across the entire energy value chain.

This balance between upfront investment and future savings creates a pathway to greater profitability for governments, utilities and investors. By prioritising investment in renewable energy, stakeholders are well placed to benefit from a more efficient and sustainable system. The NZE scenario not only advances environmental objectives but also strengthens economic resilience and financial returns over the coming decades. Electrification and renewable deployment are therefore consolidated as strategies for cost savings and revenue generation in the global energy transition.

The explosion of electricity demand in the new decade

The WEO 2025 anticipates an explosive rise in electricity demand over the coming decade, driven by the electrification of key sectors. The 2024 report announced the arrival of the “Age of Electricity”, and the 2025 edition confirms that this new era is now firmly established. In the CPS and STEPS scenarios, electricity demand increases by around 40% by 2035, rising to more than 50% in the NZE scenario.

This growth is being driven by factors such as air conditioning, advanced manufacturing, electric vehicles, data centres and the electrification of heating. The report underlines that this trend requires a secure and affordable electricity supply, with major economic and social impacts if power outages occur, such as those experienced in 2025 in Chile and the Iberian Peninsula.

SEE INFOGRAPHIC: Electricity demand growth from new uses, 2013-2035 [PDF]

SEE INFOGRAPHIC: Electricity demand growth from new uses, 2013-2035 [PDF]

Data centers and artificial intelligence: a new demand giant

Data centres and artificial intelligence (AI) are emerging as new drivers of electricity consumption, as highlighted by the WEO 2025. One of the report’s key findings reveals that investment in data centres will surpass global investment in oil supply in 2025, marking an unprecedented shift in energy infrastructure priorities.

In 2025, investment in data centres will reach $580 billion, exceeding the $540 billion allocated to the global oil supply. This growth reflects the increasing reliance on digital technologies and AI applications that require enormous computing capacity. In addition, more than 85% of new installations over the next decade will be concentrated in the United States, China and the European Union, many of them close to existing clusters, adding further pressure to already congested networks.

The report warns that this rapid rollout also entails significant risks and potential lost opportunities. Network congestion and growing connection queues, together with pressure on supply chains for key components such as transformers, cables and critical materials, could lead to substantial delays. In fact, the IEA’s analysis estimates that around 20% of new data centres planned for 2030 could face delays. In some markets, such as Dublin, one of Europe’s main data centre hubs, new connection applications have been suspended until 2028.

The continuous operation of data centres requires constant and reliable electricity, alongside a growing need for clean energy to minimise their environmental impact. Ensuring that the growth of AI and data centres is compatible with sustainability, and is not held back by infrastructure bottlenecks, requires accelerating the expansion of renewable generation, strengthening and digitalising networks and increasing their flexibility. This challenge is emerging as a critical factor in the evolution of the energy system and underlines the importance of responsibly integrating advanced technologies into the transition to net zero emissions.

Alongside the expansion of renewable energy, the WEO 2025 also highlights the growing role of nuclear generation in meeting electricity demand from data centres. The technology sector is showing increasing interest in nuclear power as a stable, emissions-free source of supply, with signed agreements and expressions of interest reaching up to 30 GW of small modular reactors (SMRs), mainly intended to power digital infrastructure. According to the IEA’s STEPS scenario, nuclear energy could provide an additional 190 TWh by 2035 to meet data centre demand, reinforcing its role as a complement to renewables in an electricity system under growing pressure from AI and digitalisation.

Air conditioning and mobility: the electrification of end-use sectors

Electrification of end-use sectors such as air conditioning and mobility is a major driver of rising electricity demand. WEO 2025 highlights that the growing use of air conditioning – driven by more frequent and intense extreme weather events and rising incomes – is rapidly increasing electricity consumption worldwide.

In the STEPS, by 2035 the expansion of air conditioning linked to higher incomes would raise peak demand by more than 330 GW, with a further 170 GW resulting from higher temperatures. In particularly hot years, extreme peaks could add an additional 260 GW. Taken together, this would increase peak demand by more than 15% compared with current levels. More than 50% of this growth is directly associated with episodes of extreme heat.

The impact is particularly strong in emerging markets, where ownership of air conditioning units is set to grow by 70% by 2035, accounting for 90% of global expansion. Extreme temperatures also affect the reliability of generation – especially in thermal power plants – by increasing the likelihood and duration of outages and reducing generation capacity. To address these risks, between 115 GW (STEPS) and 120 GW (CPS) of additional installed capacity would be required by 2035.

At the same time, the rapid growth of electric vehicles is transforming energy consumption in transport. Their fast uptake reflects policy support, falling battery costs and changing consumer preferences. Electric vehicles will account for more than 25% of global new car sales, according to the report.

Overall, rising demand from air conditioning and electric mobility illustrates how electrification is reshaping energy consumption patterns and increasing the need for a clean and reliable power supply in the coming years.

What is electric mobility?

Discover what electric mobility is, its history and its contribution to the energy transition

Descarbonización

Hacia un modelo económico bajo en emisiones de carbono

Energy self-sufficiency

The major challenges of self-sufficiency and energy security

The critical role of networks and storage for energy security

WEO 2025 warns that investment in electrical networks and storage is not keeping pace with the rapid growth in renewable capacity. Despite the essential role of smart grids in integrating wind and solar power, investment in network infrastructure continues to lag behind the needs of an increasingly electrified world.

The deployment of renewable generation set new records again in 2024, covering more than 70% of the increase in electricity demand. In the NZE scenario, installed renewable capacity would triple by 2030 compared with 2022 levels. Under this scenario, investment in network infrastructure would need to rise dramatically: 30 million kilometres of new transmission and distribution lines would be required by 2035, alongside a massive increase in battery capacity.

However, the report underlines that the need to strengthen networks is not limited to the most ambitious scenarios. Even under a current policies scenario such as the STEPS, the IEA estimates that investment in electrical networks in Europe will almost double by 2035 compared with current levels. This investment would not be directed solely towards new lines, but also towards refurbishing, digitalising and modernising existing infrastructure, a key factor in improving system efficiency and resilience.

Insufficient investment in networks and storage represents a direct risk to energy security, as outdated or inadequate infrastructure can lead to supply outages and limit the ability to balance supply and demand.

Greater resilience is also required in the face of weather-related risks, cyberattacks and other incidents that can affect critical infrastructure. Droughts, storms, flooding and wildfires are already having impacts on hydropower plants, solar facilities and other installations. Power lines are particularly vulnerable. Climate risks will increase across all scenarios due to the projected 1.5°C of warming by 2030.

The report also stresses that energy security goes beyond fuels. Critical minerals such as lithium, cobalt and nickel, which are vital for batteries and electric vehicles, present vulnerabilities due to their high geographical concentration. A single country dominates the refining of 19 of the 20 strategic minerals for energy, many of which are also essential for networks, artificial intelligence, defence and other sectors. More than half were subject to export controls as of November 2025.

Ensuring diversified and resilient supply chains is essential to secure electrification. Price spikes would affect both manufacturing and consumers. The report calls for immediate action to improve preparedness for disruptions, alongside medium-term efforts to diversify supply and mitigate structural risks.

Expanding the concept of energy security to include both electrical infrastructure and critical materials is essential to build a reliable and sustainable energy future.

The energy transition: geopolitical risks and the peak in fossil fuel demand

WEO 2025 confirms that, in the STEPS, global demand for fossil fuels – including oil and coal – will peak before 2030, while gas demand will do so around 2035. This outlook reflects the shift towards cleaner energy, driven by electrification and climate policies.

The report also highlights that geopolitical tensions remain a key factor shaping energy security, as seen in recent years. Reducing dependence on oil, coal and gas through the expansion of renewables and electrification lowers exposure to geopolitical instability and fossil fuel price volatility. The energy transition is therefore an effective strategy to mitigate geopolitical risks while advancing towards net zero emissions and the Sustainable Development Goals.

The report also warns of a loss of momentum in national and international climate commitments, just as climate risks are increasing. The year 2024 was the warmest on record and the first to exceed 1.5°C above pre-industrial levels. Energy-related emissions continue to rise due to record consumption of oil, gas and coal.

At the same time, renewables continue to grow, and faster than any other source across all scenarios. A solar boom is being accompanied by robust growth in wind, hydropower, bioenergy, geothermal and other technologies, alongside improvements in energy efficiency. China remains the world’s largest renewables market, accounting for between 45% and 60% of global deployment over the next 10 years and leading the manufacturing of most green technologies.

SEE INFOGRAPHIC: Energy related CO2 emissions by scenario, 2010-2050 [PDF]

SEE INFOGRAPHIC: Energy related CO2 emissions by scenario, 2010-2050 [PDF]

The report also notes how climate commitments have weakened in countries such as the United States, 10 years after the Paris Agreement. Although a new round of Nationally Determined Contributions (NDCs) – the climate pledges each country submits under the Paris Agreement – will be announced in 2025, these will barely alter the outcomes projected in the STEPS.

The IEA concludes that energy security challenges require decisive policies and responses that integrate affordability, competitiveness, access and climate change. The ultimate objective is to improve people’s lives.

Iberdrola, a business model with vision and leadership in electrification

The Iberdrola Group’s business model exemplifies vision and leadership in electrification, fully aligned with the conclusions of WEO 2025. The report highlights that full electrification, based on clean, reliable and intelligent systems, is the most cost-effective and secure pathway to achieving net zero emissions. Iberdrola’s long-standing commitment to renewables, network modernisation and digital innovation anticipated these trends and positions the Group at the forefront.

In September 2025, the Iberdrola Group presented its Strategic Plan 2025-2028, with the electrification of the economy as its central pillar. The plan envisages investments of €58 billion by 2028 to develop networks, particularly in the United Kingdom and the United States. This strategy enables the Group to continue its decades-long track record of driving renewables and smart grids, demonstrating a sustainable and profitable long-term vision. This approach reflects the most favourable WEO 2025 scenario, the NZE, which is also the most cost-effective.

Iberdrola is committed to bringing electricity to more people by improving and expanding the infrastructure that enables its generation capacity to be transferred to a growing number of consumers.

By leading the electrification of the economy – which is the major challenge of the 21st century – Iberdrola is not only contributing to decarbonisation objectives, but also generating value for shareholders, customers and communities, demonstrating how corporate leadership can drive environmental and economic success at the same time.