News

-

29/05/2025 - 11:51 UTC +02:00The Mexican Centre for Philanthropy (Cemefi) honours Iberdrola Mexico for its positive impact on society Iberdrola México , Iberdrola's company in that country, received the Socially Responsible Company Distinction for the 13th consecutive year. The Mexican Centre for Philanthropy (Cemefi) awards it to companies with good social responsibility practices. Cemefi's Socially Responsible Company Distinction measures and compares the development of good social responsibility practices through KPIs in the environmental, social and governance (ESG) fields. Iberdrola Mexico celebrates 25 years in the country with the goal of contributing to building a greener Mexico with the development of clean and renewable energy projects. You can read the full story in Iberdrola México's Press Room. READ MORE

-

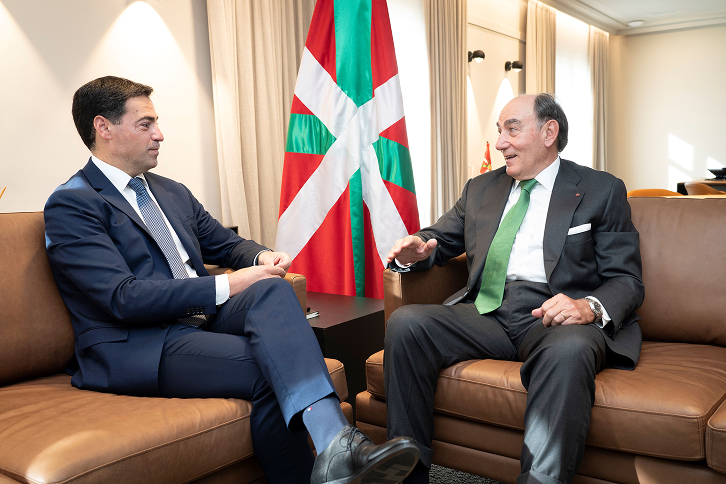

28/05/2025 - 17:00 UTC +02:00Ignacio Galán holds meetings with institutional representatives of the Basque Country This week, the Executive Chairman of Iberdrola , Ignacio Galán, held his usual meetings with the highest institutional representatives of the Basque Country: the lehendakari, Imanol Pradales; Elixabete Etxanobe, Deputy General of Bizkaia; and Juan Mari Aburto, the mayor of Bilbao. These meetings will take place, as usual, on the days prior to the General Shareholders’ Meeting in Bilbao, the company's headquarters, on Friday 30 May. At this meeting – which Iberdrola is holding at a record high stock market value, with a market capitalisation of more than €100B – the company will submit the approval of the results for the 2024 financial year to its shareholders, in which it invested €17B and increased its net profit by 17% to €5.612 B. The company has also proposed for the third consecutive year an engagement dividend of €0.005 gross per share (€1 gross per 200 shares) to be paid to all shareholders entitled to participate if a quorum of at least 70% of the share capital is reached. The company, which will present its next strategic plan on 24 September, plans to accelerate its investments to boost the electrification of the economy to more towards energy independence. READ MORE

-

28/05/2025 - 14:28 UTC +02:00Avangrid announces investment of more than €36 million to rebuild network infrastructure in New York Avangrid, Iberdrola's company in the United States , has announced five projects to improve the capacity and reliability of the electricity grid in Ithaca, New York, for a total of €36 M. This major investment adds to Avangrid's effort to modernise New York's electric and gas infrastructure with more than €440 M for 265 projects since the 2023 Reliable Energy Rate Plan. The plan reflects the critical need to invest in energy infrastructure to meet growing demand, as well as the position of the United States as a top investment priority for Avangrid and Iberdrola. Avangrid will continue its unprecedented investment plan of more than €17 B through 2030 to rebuild and reinforce critical infrastructure in all of its service areas in the Northeast. You can read the full story at the Avangrid Press Room. READ MORE

-

27/05/2025 - 18:10 UTC +02:00“What makes a company great are its values,” says Ignacio Galán upon receiving the Award for the Promotion of Spain “What makes a company great are its values,” said Iberdrola chairman Ignacio Galán during his speech as he collected the Spanish Projection Award in the Business category, presented to the company by the Spanish newspaper El Debate. These values, he said, are embodied by “the people of Iberdrola giving their all during the DANAS storms in Valencia, the storms in Scotland and the floods in Brazil”. Galán received the award “on behalf of the 44,000 people who make up Iberdrola and who truly deserve it’ and highlighted that many have been ‘the architects of the Group’s international expansion.” The third edition of the Premios a la Proyección de España (Awards for the Promotion of Spain) was held in Madrid and brought together personalities from the worlds of politics, justice, business and culture. The awards were created by the daily El Debate to recognise institutions and individuals who have made a significant contribution to the positive image of Spain. The award has three categories: institution or company, media or communications professional, and entity or personality in the field of arts and literature. As Europe’s largest electricity company and one of the two largest in the world by market capitalisation, Iberdrola has undergone a process of international expansion in less than 25 years, always taking Spanish and local companies with it wherever it operates and generating hundreds of thousands of quality jobs in Spain and around the world. In his speech, the Chairman of Iberdrola reflected on the meaning of the word “project”. In his opinion, “it has a lot to do with what Iberdrola is.” “It is making something visible. Something that needs light to be seen on a surface.” But projecting also “means drawing up a plan to carry out a project.” “Engineers project in order to transform ideas into reality, and that is what we have done throughout our history, carrying out major energy projects, in which we have invested more than €175 billion over the last 20 years, 25 of which I have been involved in, in order to expand throughout the world.” Finally, “designing is driving or moving forward, advancing, and that is why we are proud that with each of our projects we promote activity.” In this sense, he said, “we support our employees, our customers, our suppliers, our partners, our shareholders and the local communities where we operate.” All this work has placed Iberdrola in its current position of leadership. “Today we are proud to be pioneers and to be developing the latest international interconnection technologies. In the United Kingdom, specifically, we have the largest submarine connection lines in the world; in Australia, the largest batteries for hybridising our wind farms. Or the large hydroelectric projects in Spain and Portugal, and the first offshore wind farm in the United States off the coast of Massachusetts.” Behind these achievements “are thousands of suppliers who have accompanied us,” which is why “our success is the success of those who work with us.” Ignacio Galán recalled that the company brings electricity to 100 million people “from Australia to the United States, from the United Kingdom to Germany and Italy, and from Brazil to Mexico.” The Chairman ended his speech by thanking El Debate “for allowing us to share with all of you what this company and the people who work here are doing to meet the world’s current energy demands, and to create and continue creating development and wealth for people and contribute to building a more united, fairer and more sustainable world.” READ MORE

-

27/05/2025 - 15:00 UTC +02:00Iberdrola holds its Shareholders’ Day in Bilbao with the participation of Ignacio Galán Iberdrola’s Chairman , Ignacio Galán, participated today in the Shareholders’ Day held at Torre Iberdrola in Bilbao, which saw nearly a thousand attendees. As in previous years, the event precedes the General Shareholders’ Meeting 2025, which is scheduled for 30th May in Bilbao. At the event, the Chairman was joined by Asís Canales, Director of Resources and Services for the Iberdrola Group and Company Delegate in the Basque Country. During the event, shareholders had the opportunity to learn, from members of the management team, about the main activities of Iberdrola’s businesses and the various initiatives the group is undertaking to promote employment, economic activity, innovation, and social action. The meeting also reaffirmed the company’s commitment to creating value for society, highlighting the 15% increase in the dividend for shareholders, which will rise to €0.635 per share for the 2024 fiscal year. An additional €0.005 per share will be added if the quorum at the General Meeting reaches 70%. Since the beginning of 2024, Iberdrola’s shares have appreciated, reaching a market value of €100 billion, solidifying its position as the largest utility company in Europe and one of the two largest in the world. The Shareholders’ Day is one of the initiatives the company has launched throughout the year to engage with shareholders. Tenth Anniversary of the Engagement Policy This year, Iberdrola’s shareholder engagement policy celebrates its 10th anniversary. In 2015, the company’s Board of Directors approved this strategy, which is outlined in the company’s Articles of Association and is primarily focused on its thousands of investors. Iberdrola is celebrating this anniversary with a new engagement space for its shareholders. The company, led by Ignacio Galán, was a pioneer in introducing this strategy into its management, which seeks to facilitate shareholder participation in its business project by promoting transparency, active listening, and the effective dissemination of its activities throughout the year, engaging with shareholders not only during the General Meeting. Multiple Ways to Participate Iberdrola shareholders can participate in the General Meeting through a wide range of channels, provided they have at least one share registered since 23rd May. * Shareholders who are members of the OLA Shareholder Club have received a personalised card with a QR code to vote quickly and easily via the website votojunta.iberdrola.com . Club members can also participate by simply entering their share number or Club key on the same website. * This website is also available for all shareholders, whether or not they are Club members, who can register using their share number or electronic signature. * Voting is also possible via instant messaging systems. To vote through this channel, shareholders simply need to send an image of their signed proxy and remote voting card via WhatsApp (to +34 682 333 782) or Telegram (to the Junta Iberdrola account ). * Additionally, an email address, junta2025@iberdrola.es , has been set up for shareholders who prefer to send their signed cards through this channel. * Shareholders who wish to vote by phone can do so by calling the toll-free number 900 100 019. * Finally, the company has set up in-person service points in Bilbao, Madrid, Valencia, Valladolid, and Zaragoza, where shareholders can delegate and vote until Thursday, 29th May. As additional incentives, a bathrobe will be given as a gift to shareholders who visit the in-person service points, and 30 electric bicycles will be raffled among those who participate via the corporate website or the telephone channel. Moreover, the company makes information available to its shareholders continuously and promotes their ongoing engagement throughout the year through the Shareholder Office and an interactive app for members of the OLA Shareholder Club. Additionally, in-person and virtual meetings are held with shareholders in various cities across Spain throughout the year to foster ongoing dialogue, address their concerns, gather their suggestions, and provide them with information about the company. READ MORE

-

26/05/2025 - 10:36 UTC +02:00Iberdrola Australia installs Golden Row at its Broadsound PV plant Iberdrola Australia, Iberdrola's international business in Australia, has successfully installed the first row of solar panels, known as the Golden Row, at its Broadsound Solar farm in Clarke Creek, Queensland. The so-called Golden Row is an important benchmark in terms of quality and compliance, as it plays a key role in approving the design, supervising the construction and ensuring that the PV project meets all required specifications. At Broadsound, 87 solar panels make up the Golden Row. Once completed, this 377 MWdc PV plant will have around 610,000 panels, generating enough clean energy to power more than 140,000 Australian homes. In addition to the PV plant, this project includes the installation of a 180 MW battery energy storage system (BESS). READ MORE

-

22/05/2025 - 13:51 UTC +02:00Iberdrola continues its round of meetings with shareholders in Madrid ahead of its meeting on May 30 Iberdrola continued today in Madrid its round of meetings with shareholders at a meeting at Casa de América. The goal of this initiative, which began at the start of the year, is to promote a permanent, fluid and open dialogue with shareholders, who are at the core of Iberdrola's strategy, before holding its 2025 General Shareholders' Meeting on 30 May. Throughout the day, some 700 shareholders are expected to attend various presentations given by Agustín Delgado, Director of Innovation and Sustainability, Ignacio Cuenca, Director of Investor Relations, Julio Castro, CEO of Iberdrola Energía Sostenible España, Eva Mancera, CEO of i-DE, David Martínez, Director of Customer Business Spain, and Ana del Villar, Head of Shareholder Relations at Iberdrola España. In this way, the company continues with the round of meetings that began in January in Valencia and have continued in several Spanish cities. 10th Anniversary of the Engagement Policy This financial year Iberdrola's engagement policy is 10 years old. In 2015, the company's Board of Directors approved this strategy, which is set out in the Bylaws and whose main focus is its thousands of investors. The company chaired by Ignacio Galán was a pioneer in introducing this management strategy, which seeks to facilitate the participation of all its shareholders in its business project by promoting transparency, active listening and effective disclosure of its business activities on an ongoing basis throughout the year, involving them not only when the General Shareholders' Meeting is held. Iberdrola celebrates this anniversary with a new space for shareholder engagement. Multiple ways to participate All Iberdrola shareholders can participate in the meeting through a wide range of channels as long as they have at least one share registered in their name on 23 May. * Shareholders who are members of the OLA Shareholder Club will receive a company card with a personalised QR code to make voting quick and easy over the website votojunta.iberdrola.com . Club members may also participate by simply entering their number of shares or their club password on the same website. * This same website will also be available to all shareholders, whether they are members of the club or not, using their share number or electronic signature. * Voting will also be possible using instant messaging systems. To vote over this channel, shareholders will simply have to send a picture of their signed proxy and remote voting card by WhatsApp (to the number +34 682 333 782) or Telegram (to the Junta Iberdrola account ). * The e-mail address junta2025@iberdrola.es has been opened for shareholders who prefer to send their signed cards this way. * Shareholders who prefer to exercise their voting rights by telephone may do so by calling the toll-free number 900 100 019. * For those who wish to use the postal service, please send your signed card to Post Office Box 1.113, 48080 Bilbao. * The company will make information desks available to its shareholders in Bilbao, Madrid, Valencia, Valladolid and Zaragoza where they can delegate and vote from Wednesday 21 May until Thursday 29 May. As an additional incentive, a bathrobe will be given as a gift to shareholders who come to the in-person points and 30 electric bicycles will be raffled among those who participate over the corporate website or the telephone. The company also provides shareholders with information on a continual basis and promotes their ongoing engagement throughout the year through the Shareholders' Office and an interactive app for members of the OLA Shareholders' Club. In-person and online meetings are also held with shareholders in different cities in Spain throughout the year to foster ongoing dialogue, answer any questions, receive their suggestions and provide them with information about the company. The General Meeting – which Iberdrola is holding at a record high stock market value, with a market capitalisation of more than €100B – will submit to its shareholders the approval of the results for the 2024 financial year, in which the company invested €17B and increased its net profit by 17% to €5.612B. The agenda also includes the proposed distribution of a final dividend of €0.404 gross per share, which, added to the €0.231 interim dividend paid out in January, would bring the total distribution to the hundreds of thousands of savers who invest in the company to €0.635 per share, an increase of 15% over last year. In addition, the company has proposed for the third consecutive year an engagement dividend of €0.005 gross per share (€1 gross per 200 shares) to be paid to all shareholders entitled to participate if a quorum of at least 70% of the share capital is reached. READ MORE

-

22/05/2025 - 13:44 UTC +02:00Iberdrola España and Tubos Reunidos sign a power purchase agreement (PPA) Iberdrola España, a subsidiary of the Iberdrola Group in Spain, and Tubos Reunidos Group, a group specializing in the manufacture of seamless steel tubes, have signed a long-term power purchase agreement (PPA) for their production centers in Álava and Vizcaya. Under this agreement, Iberdrola España will supply a total of 120 GWh of renewable energy during the term of the contract from around 10 MW of its solar photovoltaic portfolio, thus consolidating the collaboration between the two companies, which already included the supply of clean energy with guarantees of origin. This agreement highlights Iberdrola's role in the electrification of industry , enabling Tubos Reunidos Group to continue adopting and developing innovative and sustainable solutions for the manufacture of seamless steel tubes, and will help its customers meet their goals of reducing the carbon footprint associated with their end products. You can read the full story in the Iberdrola España press room. READ MORE