What is the "Iberdrola Retribución Flexible" system?

All the information about the optional dividend system

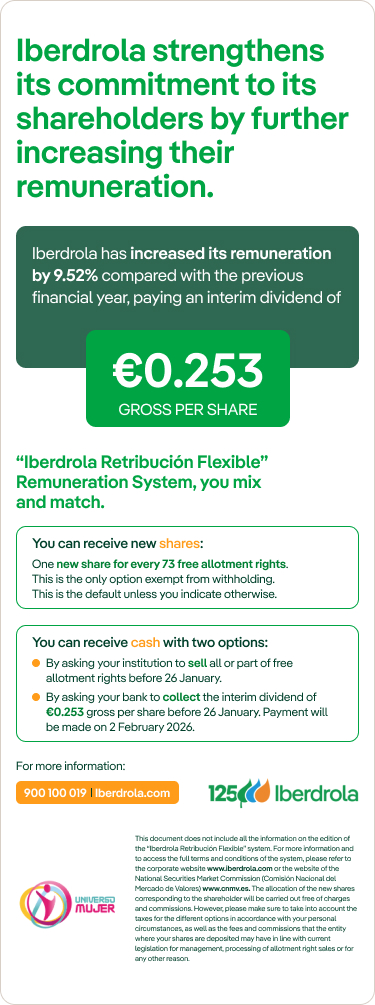

The optional dividend system "Iberdrola Retribución Flexible" offers shareholders the option to choose whether they prefer to receive all or part of their remuneration in new shares of the company or in cash.

This system is implemented through a capital increase charged to reserves and the payment of a cash dividend. All shareholders receive a free allocation right for each share they hold on the reference date, and those who wish to receive the dividend in cash must expressly waive these rights.

As a result, on the January 2026 edition of the "Iberdrola Retribución Flexible" optional dividend the shareholders will be able to choose from the following remuneration options(1):

a) Receive free newly issued shares;

b) Receive cash by selling all of a portion of the free allocation rights in the market;

c) Receive cash by means of the payment of the Interim Dividend for 2025.

Shareholders electing to receive the Interim Dividend will receive 0.253 euros gross per share, while those electing to receive shares of the company will need 73 rights for each new share.

Shareholders will be able to combine any of the options mentioned above with respect to the different groups of shares owned by each shareholder.

The value of the remuneration that shareholders will receive under options (a) and (c) above will be equivalent (in terms of market value and notwithstanding the tax treatment applicable to each of them).

1We recommend checking the deadlines for each option with your bank as they may have specific details.

“Iberdrola Retribución Flexible” system

Practical Example

-

Shareholder with 1,000 shares on the record date will receive

1,000

rights

-

Number of rights needed to get a new share

73

rights

-

Amount of the Interim Dividend

0.253

euros

In addition, shareholders do not need to choose one of the options, as they can combine them according to their requirements."

- 1 The new shares will be delivered to shareholders free of charge and fees. In accordance with the applicable law, the custodian of your shares will be entitled to charge the management fees and expenses it deems appropriate, including fees for processing purchase and sale orders of the free allocation rights.

More about the "Iberdrola Retribución Flexible" programme

-

What is it?

External link, opens in new window. -

Calendar

External link, opens in new window. -

Documentation

External link, opens in new window. -

Results

External link, opens in new window. -

Tax treatment

External link, opens in new window. -

ADR and CDI holders

External link, opens in new window. -

Frequently Asked Questions

External link, opens in new window. -

Previous dividend

External link, opens in new window.