Understanding the Regulated Asset Base (RAB) model

What is a Regulated Asset Base (RAB)?

The Regulated Asset Base (RAB) is a financial and regulatory model that defines how private investment in essential public infrastructure, such as electricity networks, water and transport, is remunerated.

Behind every socket, every electric vehicle charging point and every solar panel, there is infrastructure that requires investment, planning and confidence. This infrastructure is developed by companies such as Iberdrola and its value is recognised by regulators, allowing them to earn reasonable rates of return on that value.

The RAB model offers stability and predictability: investors know they will be able to recover their investment over time, while consumers benefit from tariffs controlled by the regulator. This balance makes the RAB an effective tool for attracting private capital to long-term strategic projects, reducing perceived risk and therefore the cost of financing.

At Iberdrola, this system has become a key lever for advancing towards a cleaner, more digital and more sustainable model.

Flexibility of electricity markets

The keys to ensure a flexible energy system

Sustainable finance

Our sustainable finance strategy

Green bonds

What are green bonds and what are they for?

What’s a data center?

Data processing centers have become fundamental for all organisations

The RAB model in the energy sector

At a time when the electrification of the economy requires large-scale, sustained investment, the RAB model has become a structural pillar of the new energy paradigm. Unlike purely competitive market-based schemes, the RAB provides predictability and legal certainty, two essential conditions for attracting private capital to critical infrastructure such as distribution networks, electricity transmission, interconnections and storage.

In the electricity sector, this approach has proved to be a driver of stability and innovation. Thanks to RAB-type regulatory frameworks, operators can undertake multi-year investment programmes, modernise their networks and improve quality of supply without being exposed to fluctuations in energy or financial markets. What’s more, the model encourages competition in productivity and technology, as companies are incentivised to optimise costs, digitalise processes and adopt more sustainable solutions in order to maximise returns within the regulated framework.

Looking ahead to 2028, Iberdrola plans to invest around €37 billion in electricity networks, with the aim of increasing its Regulated Asset Base (RAB) to €70 billion, representing an increase of €40 billion compared to 2020. Of this total, €25 billion will be allocated to distribution networks, which will reach an asset base of €50 billion, while €12 billion will be invested in transmission. Of the latter, 95% is concentrated in the United Kingdom and the United States, where the company expects to bring the asset base to around €20 billion. These plans are being developed under regulatory frameworks that are already in place or at an advanced stage of negotiation, with an estimated average return on equity (ROE) of 9.5%, reinforcing the stability and visibility of growth in its regulated business.

.

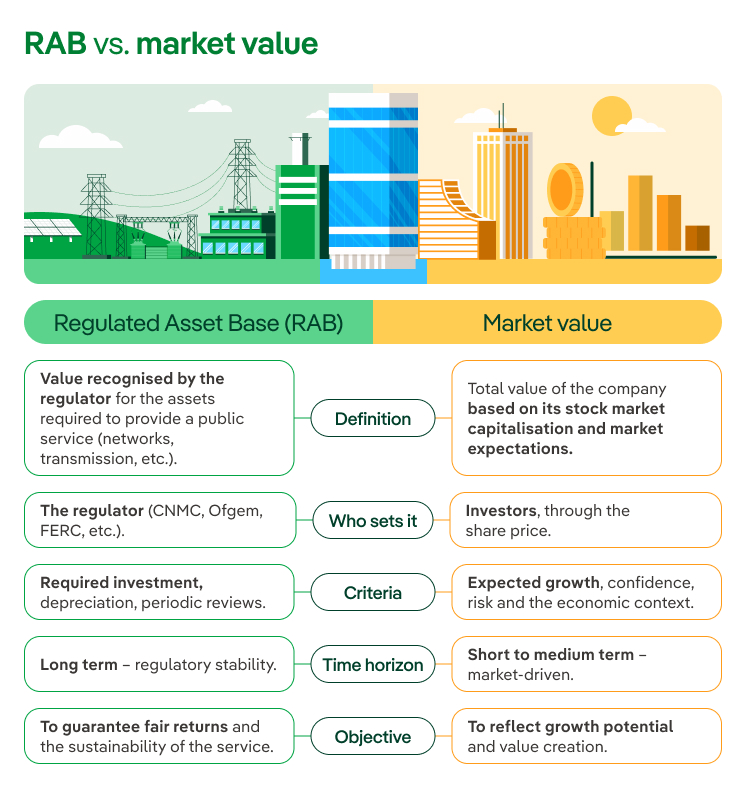

What is the difference between the RAB and market value?

The RAB represents the regulated book value of the assets required to provide a public service – for example, electricity networks. This value is determined by the regulator and serves as the reference for calculating the authorised return the company may earn. In other words, the RAB is a technical and controlled measure.

Market value, in contrast, reflects what investors are willing to pay for a company at a given point in time. It depends on factors such as growth expectations, risk perception, future profitability, confidence in the regulatory framework and conditions in financial markets.

In Iberdrola’s case, its market value typically far exceeds its Regulated Asset Base. Investors recognise its global leadership in renewable energy, its diversified international presence and its commitment to technological innovation and sustainability, which enable it to generate value beyond the regulatory framework.

Advantages of the Regulated Asset Base

The Regulated Asset Base (RAB) model offers a range of advantages that have made it an essential tool for driving investment, sustainability and innovation in the energy sector.

How asset-based regulation encourages infrastructure investment

In a context of energy uncertainty and the need for large-scale investment, asset-based regulation acts as a bridge between private capital and the public interest. Asset-based regulation encourages infrastructure investment by providing a framework of stability, transparency and predictable returns. The logic is straightforward: the regulator recognises the value of the assets required to guarantee the public service and sets a fair return on those assets, always linked to efficiency and the general interest.

By recognising the value of the assets required to deliver the service and guaranteeing reasonable remuneration on investment, this model reduces regulatory uncertainty and financial risk for companies. As a result, it encourages the mobilisation of private capital towards long-term projects such as the modernisation of electricity networks, infrastructure digitalisation and the integration of renewable energy.

At Iberdrola, this model has been key to driving the transformation of its networks businesses in the countries where it operates.

Thanks to this framework, Iberdrola has been able to plan with a long-term perspective, ensuring a steady flow of investment in critical infrastructure and contributing to the electrification of the economy. Ultimately, asset-based regulation not only boosts investment but also ensures the sustainability and reliability of the energy system, benefiting consumers, strengthening the industrial base and consolidating the transition towards a cleaner and more secure energy model.