What we do

Iberdrola, an international energy leader

With more than a century of history, we are a global energy leader and one of the largest electricity companies by market capitalisation in the world.

The Group supplies energy to nearly 100 million people in dozens of countries, has more than 500,000 shareholders, a workforce of more than 42,200 employees and assets in excess of €158 billion.

Pioneers in the electrification

We are leading the electrification to a sustainable model through our investments in renewables, smart grids, large-scale energy storage and digital transformation to deliver the most advanced products and services to our customers.

Our customers enjoy the cleanest energy through a wide range of products, services and solutions.

Overview of our business model

For more than two decades, Iberdrola has led the evolution of the energy sector, building a business model focused on investing in networks, promoting higher-value renewables, growing in storage and optimising its customer portfolio for the benefit of all.

Iberdrola focuses its business on electrification as a lever for ensuring self-sufficiency, energy security, efficiency, competitiveness and emissions reduction. This electrification process focuses on investing in networks, promoting higher-value renewables, growing storage and optimising the customer portfolio.

This consolidated and proven successful model is based on a unique mix of businesses and geographies, backed by a sound financial position and a stable dividend policy, and including sustainability and shared value creation in the business

Key features of our business model

Key performance indicators in 2024

Our figures for 2024 according to the Digital Annual Integrated Report & Sustainability Information 2024

(1) Proposal subject to approval of the final dividend by the General Shareholders' Meeting and excluding the engagement dividend.

(2) Considering organic investments and acquisitions of ENW & AGR.

(3) PwC study ‘Economic, tax, social and environmental impact of the Iberdrola Group worldwide’ (prepared using data from 2023).

Our main activities

Our brands

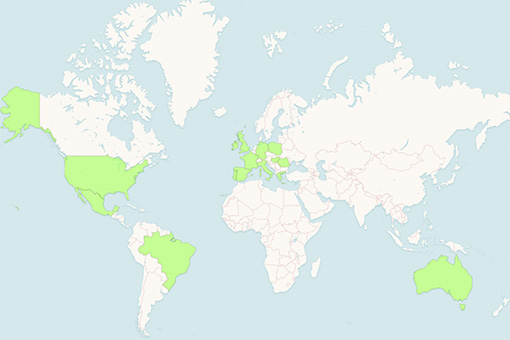

The Iberdrola Group operates in the energy sector in a number of countries in North America, South America, Europe and Oceania, and continues to add new territories as platforms for growth. All of this activity, which allows us to supply energy to some 100 million people in dozens of countries, is made possible through our six subholding companies.

Our facilities

We are leading the energy electrification a sustainable model through our renewable energy facilities, smart grids and energy storage to offer our customers the most advanced products and services.

This facilities map provides the latest quarterly update of installed capacity for all generation technologies present in the Group and our production, as well as other operational data.

Main operational dataOur facilities

We are leading the energy electrification a sustainable model through our renewable energy facilities, smart grids and energy storage to offer our customers the most advanced products and services.

This facilities map provides the latest quarterly update of installed capacity for all generation technologies present in the Group and our production, as well as other operational data.

Main operational data

Our main renewable energy projects

19 November 2025

Our investment plan

Our Strategic Plan 2025-2028 focuses on the strength of electricity networks as a key driver of electrification, investment in countries with stable regulatory frameworks and the selective growth of renewable technologies, with an emphasis on offshore wind, to achieve more predictable, profitable and secure growth.

Through this plan, we are advancing our commitment to society by creating 15,000 jobs worldwide by 2028, helping to sustain 500,000 jobs across our supply chain. In addition, we aim to combine growth with our goal of becoming carbon neutral by 2030.